[ad_1]

Lenders to Jet Airways are keeping open the option of selling 11 planes of the defunct carrier, effectively pushing the airline into liquidation, as they are increasingly frustrated with the delay in executing the resolution plan.

Bankers say the Jalan-Kalrock consortium’s failure to pay the required amount even one-and-a-half years after the National Company Law Tribunal (NCLT) approved the resolution plan, has forced them to relook at their options.

“Nobody thought that this would take so long to execute,” said a person aware of the deal. “But the fact of the matter is banks cannot transfer the company till we receive the money, and the way things are, it seems that the execution of the deal will not happen soon. Meanwhile, the 11 planes we have in our possession are also losing value. Maybe the time has come to relook at selling those.”

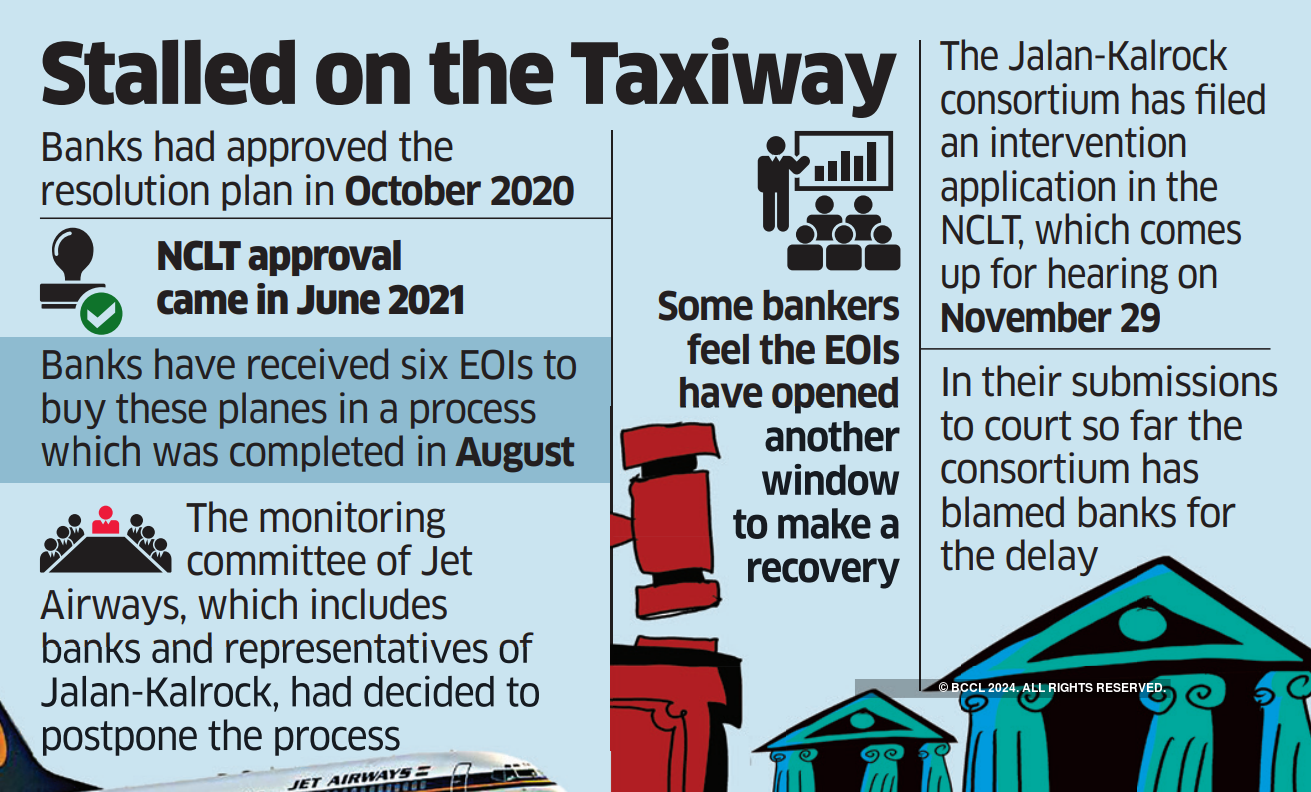

Banks had approved the resolution plan as far back as October 2020 and the NCLT approval came in June 2021.

Banks have received six expressions of interest (EoIs) to buy these planes in a process which was completed in August. However, the monitoring committee of Jet Airways, which includes banks and representatives of Jalan-Kalrock, had decided to postpone the process, ET had reported last week.

Some bankers feel that now that some interest has been received for the planes, banks have another window to make a recovery, even if a small one.

“The Jalan-Kalrock consortium has filed an intervention application in the NCLT, which comes up for hearing on November 29. Banks will watch what they say to the court and act accordingly,” said a second person aware of the case.

In their submissions to court so far the consortium has blamed banks for the delay. Bankers expect the consortium to continue that argument in the next hearing and are preparing a plan B to close the case even if it means liquidation.

Bankers said the trust deficit between them and the consortium has increased as there has been no sight of payments despite them agreeing to waive two preconditions to facilitate the takeover of the airline by the Jalan-Kalrock consortium. The plan’s implementation was conditional to the validation of Jet’s air operator’s permit, approval of the business plan, and most critically, the approval to re-allot all suspended slots including bilateral and air traffic rights.

“Though these were preconditions for the plan implementation, banks had agreed to not oppose it in court if the consortium sought relief. But instead Jalan-Kalrock has started blaming banks for the delay, which has raised doubts on their intentions,” said the first person cited above.

Last week, the consortium moved the National Company Law Appellate Tribunal (NCLAT), saying provident fund and gratuity dues of Jet employees should be paid from the airline’s existing cash balance and the rest from the lenders’ share.

This after the tribunal directed the consortium to pay gratuity and provident fund to the airline’s employees till the date of insolvency commencement in June 2019. The total claim is around Rs 275 crore.

Lenders said taking on employee liabilities is not in the approved plan and it does not make commercial sense for them to take it on their pockets.

“The haircut that banks take on this account is 95% and any other expense will erode the value banks are getting to close to liquidation. Banks would rather liquidate the company and be done with it,” said the second person cited above.

Differences have also cropped up as the consortium has not paid the first tranche of Rs 185 crore to lenders and have also laid claim to the lease rentals accrued from Air Serbia to which Jet had leased three Boeing 777 aircraft.

On their part, lenders have refused to hand over the company to the consortium before they receive the payment.

Last week, the consortium said it has temporarily reduced some employees’ salaries by up to 50% and placed some others on leave without pay effective December 1, effectively putting the onus on banks to start the airline.

[ad_2]

Source link